Whenever you are your own financial is within forbearance, the loan will remain accruing interest

In order to request mortgage forbearance, you should very first contact your servicer. The exact specifics of just how mortgage forbearance performs rely on a good partners products, just like your servicer, the kind of financial you’ve got, the underlying issues and how long you have been making month-to-month mortgage repayments. Really terminology for home loan forbearance get into 1 of 2 agreements.

- Frozen payments: Your servicer often invest in home financing pause to have a specific several months.

- Paid off repayments: Their servicer will reduce their month-to-month mortgage payments, however you will need to pay her or him for a passing fancy schedule.

The intention of such agreements will be to keep the lender out of foreclosing in your family if you’re temporarily unable to using your own month-to-month home loan repayments entirely.

Home loan Forbearance Terms and conditions

- How long your mortgage forbearance will last

- How you would repay your instalments with the servicer shortly after your financial forbearance ends up

- Their less home loan matter if you need to keep and work out month-to-month costs

- Whether your servicer have a tendency to statement their home loan forbearance in order to credit agencies

Just how long Mortgage Forbearance Lasts

The size of the latest forbearance period hinges on the amount of go out you and your servicer agree up on, together with just what was the cause of problem along with your odds of being able to go back to and make their complete month-to-month home loan repayments. As a result, home financing forbearance months get continue for a few months or doing a-year. As the purpose of financial forbearance is to offer rescue so you’re able to homeowners having small-title financial hardships, it always will not last for more than a-year.

Your servicer may also ask you to bring reputation via your financial forbearance months. Whether or not it seems like you will want a different type of recommendations otherwise an extension on your own forbearance, you might keep in touch with her or him and you may speak about the options.

Home loan Forbearance Repayment Choice

Shortly after their mortgage forbearance period ends up, you need to pay back the low or frozen matter. You are going to pay their servicer with respect to the forbearance conditions you previously establish.

- Reinstatement: One of your cost choices is a single-big date lump sum for the quicker otherwise frozen count.

- Added add up to further home loan repayments: An alternative choice to own cost was adding a specific amount to each of one’s monthly premiums until you has paid back a full forbearance number.

- Tack to the missed repayments: Finally, your ount of the installment toward prevent of your mortgage. Performing this will lengthen the term of your home loan.

You ount, that may change the regards to the loan so that your repayments could be more online payday loans in Tashua manageable. Amendment was a choice are online for people who don’t have the fund to fund a repayment bundle otherwise reinstatement or if perhaps your financial hardship continues on for a significantly longer time than just 1st anticipated.

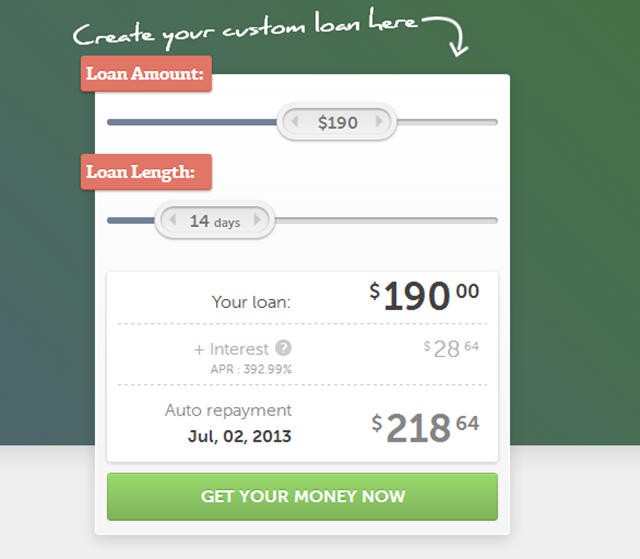

To help you be eligible for mortgage forbearance, you may need to pay increased rate of interest on your monthly installments after they restart, or if you might have to spend a one-time fee.

How to Make an application for Financial Forbearance

Once you comprehend you’re in danger of destroyed home financing fee, it’s also possible to contact the mortgage servicer, the business you send your own monthly home loan repayments so you’re able to. When you find yourself unsure which characteristics your own financial, you’ll find the business’s email address on your mortgage report.

Situations such as for instance disasters might have big date limits related to opening home financing forbearance, so you might want to contact your servicer the moment you’ll be able to. If you do therefore, understand that during unstable minutes, servicers would-be writing about a high name frequency and may be also enduring shock.

Reply