However, as home loan business struggles, this new USDA loan program continues

USDA outlying invention software began on 1, 1935, immediately following President Franklin D. Roosevelt signed an executive order one to shaped the fresh Resettlement Government. In Great Anxiety, it aided striving parents during the urban areas go on to teams structured of the federal government. Over the decades, Congress left increasing so it project. By the Oct thirteen, 1994, USDA lenders was indeed arranged according to the Government Crop Insurance Reform Act plus the Department from Farming Reorganization Operate. Now, the program continues to help some body manage belongings and increase rural communities.

USDA Funds For the COVID-19 Crisis

The new COVID-19 crisis fasten financial approvals on the nation, which have next to a 3rd regarding People in america unable to meet property money. Based on Day, submitted the highest month-to-month frequency to possess USDA money just like the 2013. Total, financing production increased more than 53% compared to same period in the last 12 months.

People who place homebuying towards the hold on account of COVID-19 could possibly get envision USDA loans to locate straight back on course. When you yourself have tight budget and the lowest credit history into the the newest article-pandemic .

Best Spot for USDA Capital

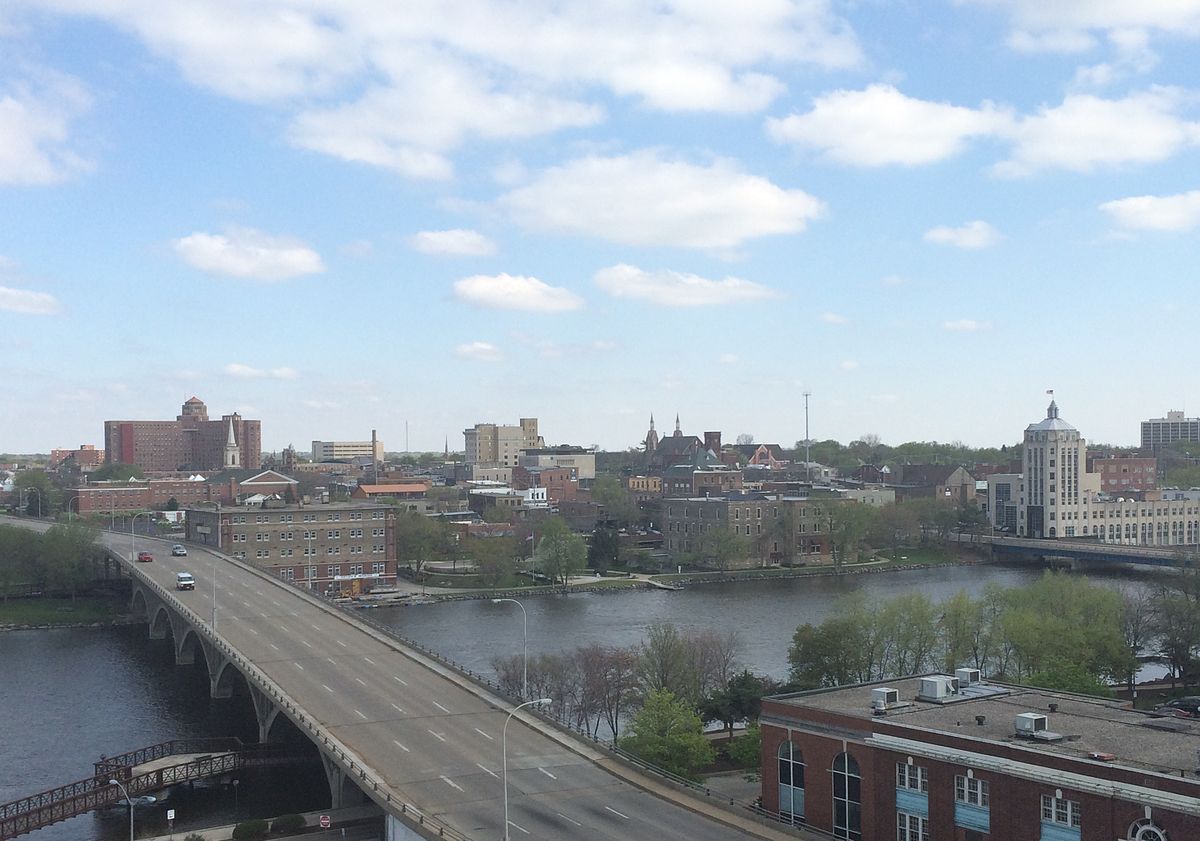

Individuals must choose assets located in qualified USDA outlying portion. These types of metropolitan areas tend to be places, villages, and you may unlock places that aren’t section of highest metropolitan areas and you can urban centers. The fresh USDA favors components that have populations less than 20,100000 anyone. No matter if oftentimes, a populace off 35,one hundred thousand tends to be accepted. Urbanized parts is actually cities with fifty,100 some one or higher.

The outlook out-of moving to an outlying urban area may seem unappealing to help you homeowners. But some metropolitan areas are qualified for USDA money. Along the You, to 97 per cent away from land bulk is qualified for rural development. When you find yourself happy to get away from a busy urban area, you might look for good venue. Contrary to what individuals imagine, of many USDA locations was residential district communities. Such cities commonly while the isolated because they appear, if you should reside in secluded metropolises.

USDA Finance vs. Old-fashioned Mortgage loans

Evaluating USDA fund that have old-fashioned mortgage loans can assist all of us find out more on the the masters. Earliest, let https://cashadvancecompass.com/installment-loans-ar/magnolia/ us discover certain requirements to possess USDA finance and exactly how they performs.

Wisdom USDA Fund

USDA financing are built getting homeowners having tight budget who are in need of to settle down from inside the outlying components. It includes 100 percent financial support, which means consumers are not necessary to make a down payment. USDA financing also provide informal borrowing from the bank criteria as compared to conventional loans, making it simpler in order to qualify for mortgages. Because these was federally-recognized financing, they will have all the way down costs than antique fund. If you are looking to maneuver off the city, consider this choice.

Credit score

Getting entitled to an excellent USDA loan, your credit score need to be at the very least 640. If you see which specifications, you’re getting streamlined running of your application. Although not, in the event your credit rating is lower than just 640, you need to submit to more rigid underwriting standards even when the software program is accepted. Your financial often comment their borrowing records so much more very carefully, which might take longer.

Pigly’s Tip!

Before you apply for a loan, definitely feedback your credit report. You might order a free of charge duplicate of the credit file during the annualcreditreport. Examine they for wrong information like unrecorded costs or good completely wrong billing target. Disputing mistakes into credit bureau will help enhance your credit get.

Money Maximum

2nd, you should satisfy approved income limitations. This new USDA sets earnings constraints at the just about 115 percent of your average house income during the a location. That it restrict relies on in your geographical area and also the size of the ones you love. Home money is estimated of the merging the latest borrower’s earnings and each adult’s money into the property. It rule is actually used regardless of the occupant’s family members label.

Reply